The Sovereign Throughput: How Energy, Compute, and Logistics Bottlenecks Are Redefining National Power

Redefining National Power in the Age of Bottlenecks

We stand at the precipice of a fundamental shift in how nations accumulate and wield power. The familiar metrics of economic strength: gross domestic product, trade balances and currency reserves increasingly resemble the wrong instruments for measuring what actually matters. These financial abstractions capture the velocity of money changing hands, not the underlying capacity to get essential work done when it counts most.

The real question facing any nation today is deceptively simple: When the world fractures along new fault lines, when supply chains snap under pressure, when energy grids buckle under demand, when data centers go dark, when ports choke with containers, what can you actually do? Not what can you buy, not what you can finance, but what can you physically accomplish with the infrastructure you control and the partnerships you can rely on.

This capacity to perform under stress, to deliver watts and computations and cargo movements at scale and on schedule, represents a nation’s throughput capacity. Unlike GDP’s backward-looking accounting of completed transactions, throughput measures forward-looking capability: the maximum sustainable rate at which a system can transform inputs into outputs while maintaining acceptable reliability standards.

Beyond the Transaction Economy

Traditional economic thinking treats infrastructure as a cost center, something that enables the real business of moving money and making deals. This perspective made sense in an era of abundant, accessible, and relatively stable global systems. But when those systems themselves become the primary constraints on national capability, the logic inverts. Infrastructure becomes the asset, and financial flows become merely the exhaust.

Consider how misleading GDP becomes during crisis moments. A country might maintain robust financial circulation through asset price inflation, services sector expansion, or debt-fueled consumption while its physical capacity to generate electricity, manufacture semiconductors, or move freight deteriorates. The mismatch only becomes apparent when external shocks test the system’s actual limits—when rolling blackouts halt production, when chip shortages cascade through entire industries, when port congestion strangles trade flows.

The pandemic offered an early glimpse of this new reality. Nations with sophisticated financial markets but fragile manufacturing capabilities found themselves unable to produce basic medical equipment. Countries with impressive digital economies discovered their supply chains could be severed by a single container ship blocking a canal. Regions rich in natural resources watched helplessly as refining bottlenecks prevented them from accessing their own energy reserves.

The Throughput Capacity Framework

Real national strength emerges from a more fundamental equation that captures the reliable work a system can perform:

Throughput Capacity equals Nameplate Capacity multiplied by Capacity Factor, Interoperability Coefficient, and Reliability Factor.

Each component reveals something crucial about how theoretical potential translates into practical capability. Nameplate capacity represents the headline numbers—installed megawatts, peak computational power, maximum port throughput. But nameplate figures assume perfect conditions that rarely exist in practice.

The capacity factor acknowledges that nothing runs at full theoretical output. Power plants require maintenance, data centers consume their own electricity for cooling, ports lose efficiency during shift changes and weather delays. A nation might boast impressive installed solar capacity while struggling with storage limitations that render much of that power unavailable when needed most.

The interoperability coefficient captures perhaps the most overlooked dimension of national capability, how well different systems work together. A country might possess abundant energy resources, sophisticated manufacturing capacity, and efficient logistics networks, but if these systems cannot communicate effectively, transfer loads seamlessly, or coordinate responses to disruption, their combined effectiveness plummets. Standards matter. Protocols matter. The ability to route power across grid boundaries, share computational workloads across data centers, and transfer cargo between different transport modes without friction determines whether individual assets can be combined into systemic capability.

The reliability factor forces honest accounting of what happens when things go wrong—which they inevitably do. Planning for average conditions while ignoring tail risks creates brittle systems that fail precisely when they are needed most. The nations that will thrive in coming decades are those building infrastructure designed to function reliably during the 95th percentile stress conditions, not just the 50th percentile.

The Deception of Financial Flows

Traditional economic measurement focuses on transactions, treating the movement of money as the primary indicator of productive activity. But transactions can increase even as underlying productive capacity declines. Financial engineering can boost quarterly numbers while critical infrastructure ages toward failure. Leverage can amplify apparent growth while real capability stagnates.

The 2008 financial crisis demonstrated how far financial abstractions could diverge from physical reality in the banking sector. The coming decades will reveal similar divergences in infrastructure. Nations with impressive financial metrics but deteriorating throughput capacity will discover their vulnerability during the next major disruption, whether triggered by geopolitical conflict, climate events, technological competition, or some combination of these forces.

This shift demands new metrics focused on flow rates rather than stock valuations, on maximum sustainable output rather than peak theoretical performance, on reliability under stress rather than efficiency under ideal conditions. The countries that develop these metrics first, and structure their policies around throughput optimization rather than GDP maximization, will define the terms of international competition for generations to come.

The evidence already surrounds us in the form of lengthening delays for critical equipment, increasing frequency of grid emergencies, growing queues for data center capacity, and persistent logistics bottlenecks. These are not temporary disruptions to be smoothed over with financial solutions. They represent the emergence of throughput constraints as the binding limit on national capability.

The question is not whether this transition will occur, but which nations will recognize it first and structure their approach to power accordingly. The sovereign throughput suggests that energy capacity, computational resources, and logistics capability represent the new foundations of national strength. Everything else flows downstream from these three bottlenecks.

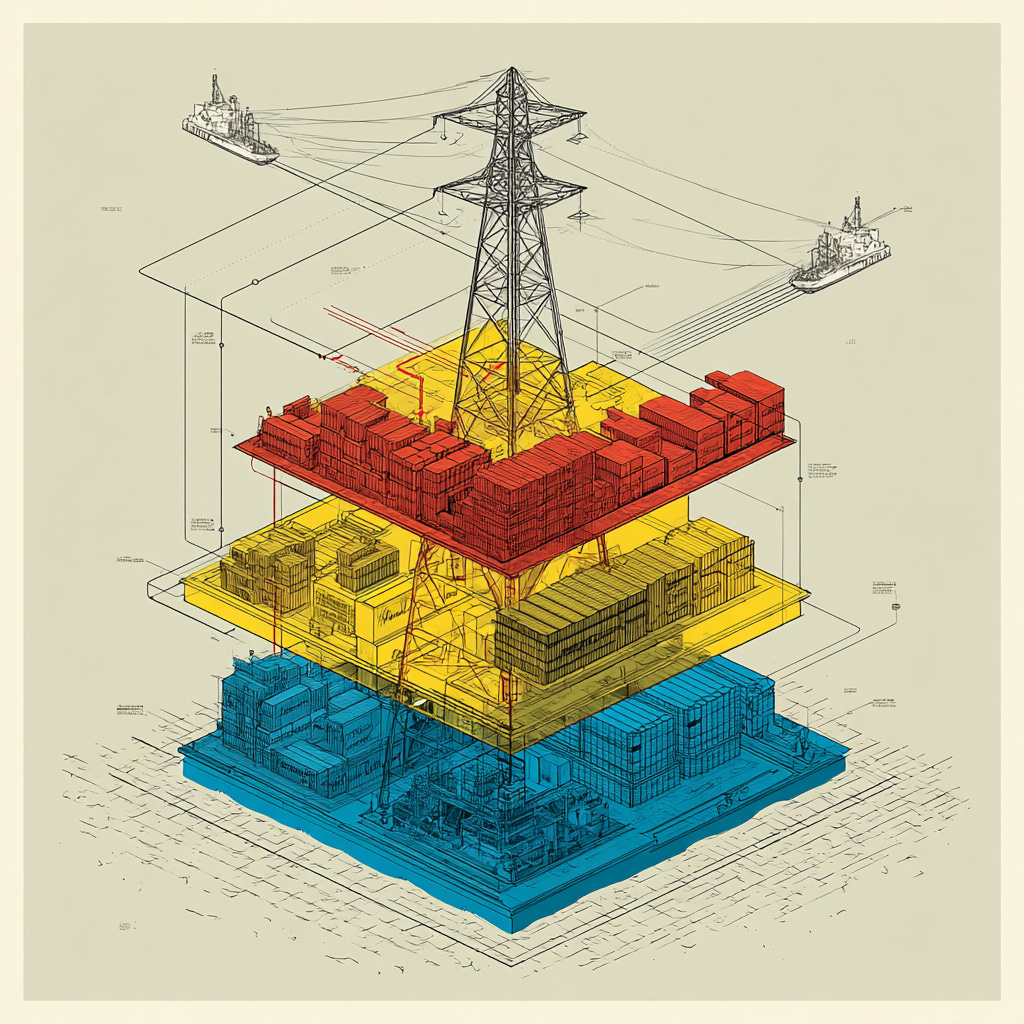

The Scarcity Stack: Where Bottlenecks Become Battlegrounds

The architecture of modern civilization rests on three foundational layers, each riddled with increasingly visible constraints. These layers: energy systems, computational infrastructure, and logistics networks form what can be understood as the scarcity stack. Unlike the familiar technology stacks that define software systems, the scarcity stack operates in the physical world where atoms move slowly, equipment takes years to build, and failures cascade through interconnected systems with devastating speed.

Each layer exhibits its own characteristic bottlenecks, but the real complexity emerges from their interdependence. Advanced semiconductor fabrication requires enormous amounts of stable electricity and sophisticated logistics coordination. High-performance computing centers demand reliable power and efficient cooling while generating logistics challenges around equipment installation and maintenance. Port automation increases computational requirements while reducing energy costs per container moved. These cross-layer dependencies mean that weakness in any single layer compromises the entire stack.

The Watts Layer: Generation, Storage, Wires, and Fuels

Energy represents the foundation of the scarcity stack, yet modern power systems have evolved into baroque contraptions that prioritize financial optimization over physical reliability. The fundamental challenge lies not in generating electrons. Renewable technologies have made energy production increasingly abundant during optimal conditions. The real challenge is delivering the right amount of power to the right location at precisely the right moment, regardless of weather, demand spikes, or equipment failures.

The generation portfolio that seemed adequate for a world of predictable industrial loads buckles under the variable demands of data centers that can double their consumption in minutes, electric vehicle charging that creates new peak demand patterns, and renewable sources that produce power according to atmospheric conditions rather than human schedules. Wind farms generate maximum output during overnight hours when demand traditionally reaches its minimum. Solar installations flood the grid with midday power while contributing nothing during evening peak periods.

This temporal mismatch between supply and demand has created an emerging storage bottleneck that most energy planning still fails to address honestly. Battery installations receive substantial attention and investment, but the scale required to buffer meaningful amounts of grid-level power remains staggering. A few hours of storage at current costs would consume budgets larger than most countries spend on defense. Pumped hydro storage offers greater scale but requires specific geological conditions and decades of environmental permitting. Other storage technologies remain either unproven at scale or prohibitively expensive.

The transmission and distribution infrastructure compounds these challenges through what can only be described as systematic underinvestment in decidedly unsexy but absolutely critical components. High-voltage transformers, the massive devices that step electricity up and down between transmission and distribution voltages, require custom manufacturing with lead times extending beyond two years. A single transformer failure can black out hundreds of thousands of people for months. The United States maintains no domestic manufacturing capacity for the largest units, depending entirely on foreign suppliers who prioritize their home markets during shortages.

Similar constraints plague every aspect of grid infrastructure. Circuit breakers capable of safely interrupting high-voltage faults take over a year to manufacture and install. Underground transmission cables require specialized installation equipment and techniques possessed by only a handful of global contractors. Even basic distribution equipment faces lengthening lead times as global demand outpaces manufacturing capacity.

The fuel security dimension reveals additional layers of vulnerability. Natural gas plants provide crucial dispatchable power but depend on pipeline infrastructure that represents attractive targets for disruption. Nuclear facilities require uranium enrichment services dominated by a small number of global suppliers. Coal plants, despite their environmental drawbacks, offer fuel security advantages through the possibility of maintaining large on-site stockpiles, but face regulatory pressure and financing constraints that limit new construction.

The operational metrics that actually matter differ dramatically from the renewable energy targets that dominate policy discussions. Firm capacity per capita—the amount of power guaranteed to be available during peak demand periods—provides a better measure of grid reliability than installed renewable capacity. Storage hours at peak demand reveal whether ambitious renewable installations can actually deliver power when needed. The percentage of industrial load covered by long-term contracts indicates whether critical facilities can maintain operations during supply shortages.

Energy represents the foundation of the scarcity stack, yet modern power systems have evolved into baroque contraptions that prioritize financial optimization over physical reliability. The fundamental challenge lies not in generating electrons, since renewable technologies have made energy production increasingly abundant during optimal conditions, but in delivering the right amount of power to the right location at precisely the right moment, regardless of weather, demand spikes, or equipment failures.

The Compute Layer: Fabs, Data Centers, Networks, and Models

The computational infrastructure layer exhibits bottlenecks so severe they resemble wartime resource allocation more than normal market dynamics. Advanced semiconductor manufacturing has concentrated in a small number of facilities using equipment produced by an even smaller number of specialized suppliers. The most advanced logic chips, the kind required for artificial intelligence training and high-performance computing, can be manufactured at perhaps a dozen facilities globally, most located within a few hundred miles of potentially contested waters.

The extreme ultraviolet lithography tools required for cutting-edge chip production represent perhaps the most concentrated industrial bottleneck in history. A single Dutch company produces these machines, which require components from suppliers across multiple continents and cost over $200 million each. The installation process takes months, the maintenance requires constant attention from specialized technicians, and the operational requirements include vibration-free foundations and ultrapure water systems that can cost more than the buildings housing them.

Wafer starts per month—the number of silicon wafers processed through advanced fabrication facilities—provides the most direct measure of global semiconductor production capacity. Unlike software metrics that scale nearly infinitely, wafer processing operates under hard physical constraints. Each wafer takes weeks to process through hundreds of individual steps. Production lines require months of setup time and cannot be quickly reconfigured for different products. The capital requirements for new fabrication facilities have grown so large that only the most sophisticated companies can afford them, and the time from construction start to volume production extends beyond half a decade.

Data center infrastructure faces its own set of accumulating constraints. The power requirements of modern artificial intelligence workloads have grown exponentially, with individual server racks consuming more electricity than entire households. The cooling systems required to extract waste heat from these dense installations consume additional power and require sophisticated engineering to prevent thermal failures. The specialized networking equipment needed to connect thousands of high-performance processors operates at the edge of current technology and faces similar supply constraints as the processors themselves.

High-bandwidth memory represents an emerging bottleneck that receives less attention than processors but may prove equally constraining. The memory stacks required for artificial intelligence applications use advanced packaging techniques that require specialized equipment and materials. Production capacity remains concentrated among a small number of suppliers, and demand growth from AI applications has created allocation challenges reminiscent of automotive chip shortages but with potentially larger economic consequences.

The networking infrastructure that connects computational resources faces bandwidth limitations that compound with distance and complexity. Fiber optic cables provide enormous theoretical capacity, but the transceivers, routers, and switches required to utilize that capacity face their own manufacturing constraints. Submarine cable systems that connect continents require specialized ships and installation techniques controlled by a small number of global contractors. Landing stations where these cables reach shore represent concentrated points of vulnerability that few countries adequately protect.

Model training and deployment creates the final bottleneck in the computational stack. The largest AI models require coordinated access to thousands of high-performance processors for weeks or months of continuous operation. The scheduling complexity alone demands sophisticated software systems, while the hardware coordination requires new networking protocols and storage systems. The intellectual property constraints around advanced models create additional access limitations that may prove more binding than hardware availability.

The Logistics Layer: Sea, Rail, Road, Air, Warehousing, and Corridors

Physical movement of goods faces bottlenecks that have accumulated over decades of optimization for cost rather than resilience. Maritime shipping, which carries the vast majority of international trade by volume, depends on infrastructure and operational practices that exhibit systemic vulnerabilities. Port facilities require specialized equipment—container cranes, rail connections, truck staging areas—that takes years to install and decades to fully optimize. The largest container ships cannot dock at smaller ports, creating concentration risk at major terminals.

The crane fleets that load and unload container ships present a particularly acute concentration risk. A single Chinese manufacturer supplies the majority of large container cranes globally. These machines require constant maintenance, specialized parts, and software systems that create ongoing dependencies long after initial installation. The time required to manufacture, transport, and install new cranes extends beyond two years, making rapid capacity expansion impossible during surge periods.

On-dock rail connections, which allow containers to transfer directly from ships to trains without truck transport, remain unavailable at many major ports despite their obvious efficiency advantages. The infrastructure changes required to accommodate rail connections demand coordination between port authorities, railroad companies, and terminal operators—coordination that proves difficult even when all parties recognize the benefits. Existing terminals often lack the physical space for rail infrastructure, creating a chicken-and-egg problem where rail service remains unavailable because infrastructure is missing, while infrastructure investments remain unjustified because rail service doesn’t exist.

Inland transportation systems exhibit their own characteristic bottlenecks. Rail networks face capacity constraints during peak shipping seasons, with available slots allocated months in advance. The specialized chassis required to move containers from ports to inland destinations suffer from utilization imbalances, empty chassis accumulate at inland locations while ports face shortages. Driver shortages in trucking create service delays and cost increases that ripple through supply chains.

Air cargo capacity, crucial for high-value and time-sensitive shipments, remains constrained by airport infrastructure and aircraft availability. Dedicated cargo aircraft require specialized ground handling equipment and trained personnel. Passenger aircraft that carry belly cargo reduce freight capacity when travel demand declines. The airports capable of handling large cargo aircraft concentrate in major metropolitan areas, creating geographic bottlenecks for time-sensitive shipments.

Warehousing and distribution facilities face their own space and location constraints. Modern e-commerce operations require warehouse facilities near population centers, but available land near major cities commands premium prices and faces zoning restrictions. The automated systems that enable efficient warehouse operations require substantial capital investments and specialized maintenance capabilities. During peak seasons, available warehouse space becomes scarce, forcing companies to accept suboptimal locations or service levels.

Customs and border processing creates administrative bottlenecks that compound physical infrastructure constraints. Digital systems that could accelerate clearance procedures remain inconsistent across different ports and countries. Manual inspection requirements create unpredictable delays that force shippers to build buffer time into delivery schedules. The regulatory complexity of international trade requires specialized knowledge that becomes scarce during personnel shortages.

Cross-Layer Coupling and Cascade Effects

The three layers of the scarcity stack interact in ways that amplify individual bottlenecks into systemic vulnerabilities. Data center construction consumes electrical generation capacity before the facilities become operational, tightening power markets in regions with large digital infrastructure investments. Advanced semiconductor fabrication requires both enormous amounts of stable electricity and sophisticated logistics coordination for chemical supplies and finished products. Automated ports reduce labor requirements but increase computational and electrical demands.

These interdependencies mean that stress in any single layer propagates through the entire stack. Power shortages shut down manufacturing facilities and disrupt logistics networks. Semiconductor shortages halt production of electrical generation and transportation equipment. Logistics bottlenecks prevent delivery of critical components needed for infrastructure maintenance and expansion.

The coupling effects create positive feedback loops that can rapidly transform manageable shortages into systemic crises. A port closure forces cargo diversion to facilities that lack adequate capacity, creating congestion that spreads throughout regional networks. Power plant outages increase demand on remaining facilities, raising the probability of additional failures. Component shortages force manufacturers to hoard inventory, exacerbating supply constraints.

Understanding these interactions reveals why isolated infrastructure investments often fail to deliver expected benefits. Adding generation capacity without upgrading transmission infrastructure creates bottlenecks that prevent power delivery. Installing additional port cranes without improving inland transportation creates terminal congestion. Building new data centers without securing reliable power supplies creates stranded assets.

The nations that will thrive in coming decades are those that recognize these systemic interdependencies and structure their infrastructure investments accordingly. Rather than optimizing individual layers in isolation, they will design systems that strengthen the entire stack and build redundancy that can absorb failures without cascade effects. This approach requires longer-term thinking, larger upfront investments, and coordination across traditionally separate sectors—but it offers the only path to genuine resilience in an increasingly connected and vulnerable world.

Strategic Options and the Balance Sheet View: Building Sovereign Capacity in an Age of Interdependence

The recognition that throughput capacity defines national power immediately raises the question of strategy: How should nations navigate the complex tradeoffs between self-reliance and efficiency, between redundancy and cost optimization, between sovereignty and specialization? The answer lies not in blanket protectionism or naive globalism, but in sophisticated portfolio thinking that treats infrastructure capacity as a strategic asset requiring active management under uncertainty.

The traditional binary between domestic production and foreign dependence obscures a rich spectrum of institutional arrangements that can secure access to critical capacity while managing different types of risk. Nations need frameworks for deciding when to build, when to partner, and when to contract—frameworks that account for the specific characteristics of different infrastructure layers and the evolving geopolitical landscape that shapes their vulnerability.

The Strategic Portfolio Approach: Own, Ally, or Rent

Every critical infrastructure component presents a strategic choice that can be analyzed through the lens of time horizons, substitutability, and veto risks. The decision matrix emerges from asking three fundamental questions: How quickly can alternative capacity be accessed if current arrangements fail? How many credible alternatives exist in the global market? What is the probability that external actors will weaponize their control over this capacity?

The answers to these questions point toward one of three strategic postures, each with its own cost structure, risk profile, and operational requirements.

When Sovereignty Demands Ownership

Direct state control becomes necessary when three conditions align: critical mission requirements that cannot tolerate external veto, long lead times that prevent rapid substitution, and concentrated global supply chains that create systemic vulnerability. These characteristics describe an uncomfortable number of infrastructure components that underpin modern civilization.

High-voltage transformers exemplify this category perfectly. These massive devices require two to three years to manufacture and install, during which time electrical grids remain vulnerable to equipment failures. The global manufacturing capacity concentrates among a handful of suppliers who prioritize their domestic markets during shortages. A single transformer failure can black out hundreds of thousands of people for months, making external dependency on these components tantamount to surrendering basic governmental functions.

The strategic response requires thinking beyond traditional procurement toward state-sponsored industrial capacity. Build-own-operate arrangements, where governments directly finance and control critical infrastructure, represent one approach. Strategic state-owned enterprises that maintain domestic manufacturing capability for critical components represent another. Golden share arrangements that give governments veto power over capacity allocation provide a lighter-touch alternative that preserves market mechanisms while ensuring access during emergencies.

The key insight is that ownership decisions must account for entire supply chains, not just final products. Domestic transformer manufacturing provides little security if the specialized steel, insulating oil, or control electronics remain concentrated among foreign suppliers. True sovereign capacity requires mapping dependencies several layers deep and identifying the minimal viable domestic footprint needed to maintain operational independence.

Advanced semiconductor manufacturing presents the most complex ownership challenge. The capital requirements for cutting-edge fabrication facilities have grown so enormous that only the largest corporations and wealthiest nations can afford them. The technical expertise required spans dozens of highly specialized fields, from materials science to precision engineering. The equipment supply chains involve hundreds of companies across multiple continents.

Yet the strategic importance of advanced chips makes some level of domestic capability essential for any nation seeking technological sovereignty. The solution may lie in targeted investments in specific segments of the value chain rather than attempting to replicate entire ecosystems. Secure packaging facilities, specialized testing capabilities, or design expertise can provide meaningful independence even without complete vertical integration.

When Mutual Dependence Enables Alliance

Alliance strategies become viable when critical capabilities can be secured through relationships with partners who face similar vulnerabilities and possess complementary strengths. The key requirement is credible mutual dependence—arrangements where all parties have strong incentives to maintain access and sufficient leverage to enforce cooperation.

Energy security provides the clearest examples of successful alliance strategies. Liquefied natural gas markets have evolved sophisticated swap arrangements where suppliers guarantee delivery to alliance partners even during their own shortages. Pipeline interconnections allow neighboring countries to balance supply and demand across regional networks. Strategic petroleum reserves can be coordinated to provide mutual insurance against supply disruptions.

The success of these arrangements depends on careful institutional design that aligns incentives and creates credible commitments. Joint ventures that require all partners to contribute capital and expertise create stronger bonds than simple supply contracts. Reciprocal capacity reservations, where each partner maintains standby capability for others, distribute costs while ensuring availability. Cross-licensing agreements for critical technologies prevent any single party from blocking access to essential capabilities.

Computational infrastructure offers emerging opportunities for alliance strategies, though the institutional frameworks remain underdeveloped. Cloud computing already demonstrates the technical feasibility of sharing computational resources across geographic boundaries. The extension to sovereign workloads requires additional security guarantees and access assurances, but the basic architecture exists.

The challenge lies in creating commitments that survive political pressure. Trade relationships that seem robust during normal times often collapse when one party faces domestic pressure to prioritize national interests. The alliances that endure are those where breaking commitments inflicts immediate and substantial costs on the defecting party, not just long-term reputational damage.

Successful alliance strategies also require redundancy within the partnership structure. Bilateral arrangements remain vulnerable to political changes in either country. Multilateral frameworks that can function even if individual members withdraw provide greater stability. The most resilient alliances include partners with diverse political systems and economic structures, making coordinated pressure from external actors more difficult.

When Markets Provide Sufficient Options

Rental strategies, relying on market mechanisms and contractual arrangements rather than ownership or formal alliances, make sense when multiple credible suppliers exist, substitution costs remain manageable, and the strategic importance of uninterrupted access remains limited. These conditions apply to a smaller range of critical infrastructure components than commonly assumed, but they do exist.

Container shipping provides one example where market mechanisms generally function effectively. Multiple shipping lines serve major trade routes, vessels can be redirected between routes relatively quickly, and alternative transportation modes exist for high-priority cargo. The commodity nature of basic shipping services limits the ability of any single provider to extract strategic rents or threaten supply cutoffs.

Even within rental strategies, sophisticated contracting can provide additional security at reasonable cost. Pre-negotiated surge pricing arrangements prevent suppliers from exploiting emergency conditions. Take-or-pay contracts guarantee access to capacity even if short-term demand fluctuations make utilization uneconomical. Options contracts provide the right to access additional capacity during peak periods without paying for unused resources during normal times.

The key insight is that rental strategies require active risk management, not passive reliance on spot markets. Emergency backup arrangements, diversified supplier relationships, and hedging instruments can provide substantial security while preserving cost advantages. The nations that execute rental strategies successfully are those that invest in market intelligence, maintain option portfolios, and develop rapid switching capabilities.

Implementation Architecture: From Strategy to Operations

Translating strategic frameworks into operational capability requires institutional innovations that span traditional bureaucratic boundaries. Energy security, computational capacity, and logistics efficiency cut across multiple government agencies, regulatory authorities, and private sector stakeholders. The coordination challenges alone can defeat otherwise sound strategies.

Capacity-as-a-service contracts represent one promising approach for bridging the gap between public strategic needs and private operational efficiency. Rather than purchasing assets directly, governments can contract for guaranteed access to specific amounts of capacity with defined service levels and penalty structures. This approach allows private sector entities to maintain operational control and efficiency incentives while providing public sector entities with the security of guaranteed access.

The implementation details matter enormously. Service level agreements must specify not just average performance but performance during specified stress scenarios. Penalty clauses must be large enough to ensure compliance but not so large as to make contracts uneconomical. Force majeure clauses must distinguish between genuinely unforeseeable events and predictable supply chain disruptions that competent operators should anticipate.

Evergreen procurement represents another institutional innovation that can smooth supply chain volatility while building strategic relationships. Rather than issuing periodic solicitations for specific requirements, governments can establish ongoing procurement relationships that provide suppliers with predictable demand streams. This approach encourages suppliers to maintain production capacity and inventory levels that would be uneconomical with sporadic ordering patterns.

The success of evergreen procurement depends on accurate demand forecasting and flexible contract structures. Requirements that fluctuate wildly from year to year defeat the purpose of providing supply chain stability. Contract terms that lock in prices or specifications for extended periods prevent adaptation to technological changes or market evolution.

Mandatory interoperability standards provide perhaps the highest-leverage intervention available to governments seeking to strengthen throughput capacity. Standards that ensure compatibility between equipment from different suppliers prevent vendor lock-in and enable rapid capacity expansion during emergencies. Open interfaces that allow third-party software to manage infrastructure systems prevent single points of control.

The challenge lies in developing standards that promote competition without stifling innovation. Standards developed through inclusive processes with broad industry participation generally achieve better compliance than those imposed unilaterally. Technical standards that focus on interfaces and protocols rather than internal implementations provide flexibility for continued innovation. Sunset clauses that require periodic review prevent standards from becoming barriers to technological progress.

The Balance Sheet Approach: Infrastructure as Strategic Asset

The ultimate insight of the throughput capacity framework is that nations should manage their infrastructure portfolios with the same sophistication that corporations apply to balance sheet management. This means treating infrastructure investments not as consumption or transfer payments, but as assets that generate ongoing returns through enhanced national capability.

The asset side of a national throughput balance sheet includes firm generating capacity, energy storage duration, transmission interconnection capability, computational capacity accessible under stress conditions, manufacturing capability for critical components, port throughput capacity, inland transportation capacity, and emergency stockpiles of critical materials. Each asset generates value through its contribution to national throughput capacity, but the value depends critically on operational factors like maintenance quality, operator training, and system integration.

The liability side includes single points of failure that can disable large portions of national capability, regulatory bottlenecks that prevent rapid capacity expansion, supplier concentration risks that create external veto points, aging infrastructure that faces increasing failure probability, skills gaps that prevent effective operation of existing systems, and cybersecurity vulnerabilities that create attack vectors for hostile actors.

The equity position, understood as the resilience margin that enables a nation to absorb shocks and maintain essential functions, emerges from the difference between assets and liabilities. Unlike corporate balance sheets, where equity represents a financial cushion, national throughput equity represents the ability to maintain civilization during extended periods of external pressure or internal disruption.

This balance sheet perspective reveals why reliability compounds over time in ways that pure capacity additions do not. Preventive maintenance programs that reduce failure rates increase the reliability factor in the throughput capacity equation without requiring new construction. Standardization efforts that improve interoperability between systems increase the coefficient that determines how effectively individual assets combine into systemic capability. Training programs that develop operator expertise increase the practical capacity factor of existing infrastructure.

The compounding nature of reliability investments suggests that nations should allocate resources to maintenance and optimization with the same priority as new construction. A power grid with excellent maintenance practices and trained operators can deliver higher throughput capacity than a grid with newer equipment but poor operational practices. Port facilities with optimized software systems and efficient procedures can achieve higher throughput than ports with more modern cranes but suboptimal workflows.

Capital Allocation Under Uncertainty

The strategic frameworks outlined above provide guidance for individual decisions, but they must be integrated into systematic capital allocation processes that account for the interdependencies and uncertainties that characterize the modern world. The capital allocation rules that emerge from throughput thinking differ substantially from traditional infrastructure investment approaches.

First, fix bottlenecks rather than optimizing metrics. Adding generating capacity provides no value if transmission bottlenecks prevent power delivery. Installing additional port cranes provides no benefit if inland transportation remains constrained. The highest-return investments target the limiting constraints in integrated systems rather than the most visible or politically appealing components.

Second, purchase scarce, long-lead-time equipment early and in bulk. The components that constrain throughput capacity are precisely those with the longest delivery times and most concentrated supply chains. Purchasing these components before immediate need arises reduces project timelines and provides insurance against supply chain disruptions. Bulk purchasing agreements can secure better pricing while guaranteeing supplier attention during high-demand periods.

Third, prioritize investments that reduce time-to-capacity over those that reduce operating costs. In a world where capacity scarcity exceeds cost optimization as a constraint on national capability, the ability to rapidly expand throughput provides more strategic value than marginal efficiency improvements. Permitting process reforms that reduce project timelines often provide higher returns than technological improvements that reduce construction costs.

Fourth, fund control software and systems integration as infrastructure rather than as operational expenses. The software systems that coordinate complex infrastructure networks determine how effectively physical assets combine into systemic capability. Investments in grid management software, port operating systems, and logistics coordination platforms generate returns comparable to concrete and steel but receive less attention because their contributions are less visible.

Fifth, maintain option value through strategic land banking, pre-permitted development sites, and mothballed infrastructure. The ability to rapidly scale capacity during emergencies requires advance preparation that may appear wasteful during normal times. Nations that maintain development-ready sites, pre-approved expansion plans, and standby equipment can respond to changing circumstances with speed that provides decisive advantages.

The implementation of these principles requires institutional arrangements that can balance long-term strategic thinking with short-term operational efficiency. Traditional government agencies often lack the technical expertise and operational flexibility required for sophisticated infrastructure portfolio management. Pure market mechanisms often fail to provide adequate investment in strategic redundancy and emergency preparedness.

The solution may lie in hybrid institutional arrangements that combine public strategic direction with private operational expertise. National infrastructure investment funds, infrastructure banks with strategic mandates, and public-private partnerships with carefully structured incentives can provide the institutional foundation for executing throughput-focused capital allocation strategies.

The nations that develop these capabilities first will define the terms of international competition for decades to come. The transition from GDP-based to throughput-based measures of national strength represents more than an accounting change, it represents a fundamental shift in how power accumulates and operates in an interconnected but increasingly fragmented world. The countries that recognize this shift and restructure their institutional arrangements accordingly will discover that control over throughput capacity provides leverage that financial wealth alone cannot match.

You are now my favorite Substack. Please consider investigating the academic transition from post-structuralism to postmodernism starting in the 1980s. The reason people are not being taught to think structurally in school, and instead are having their heads filled with postmodern nonsense, is that structuralism is the ultimate form of accountability whereas postmodernism will never hold anyone to account.

This article sounds interesting. Please write an introductory shorter one for dummies.